INVESTOR SYNDICATE

The #1 Community For Real Estate Investors

Launch & Grow a Successful Real Estate Investing Business

EVERYTHING YOU NEED TO SUCCEED

IN REAL ESTATE INVESTING

Video Lessons

Step by Step Training Modules Of How To Launch & Grow Your Business

Tools & Resources

All The Softwares, Tools And Templates You Need to Get Your Business Off The Ground

Live Training Calls

Access to Live Meetings and Recordings Giving You The Exact Framework to Scale

Private Investor Community

Get Access to our Private Real Estate Investing Community with Investors From Across The Nation

PROVEN FRAMEWORK

Stop wasting your time and money on mentorship programs that don't give you the results you want. Our real estate investing system is different. We don't just teach you theories; we show you the exact step by step process to build a successful real estate investing business.

We teach you how to launch and grow your real estate investing business from the ground up, with proven training, helpful tools, and powerful community of real estate investors from across the nation.

Our community is here to support you along your real estate investing journey.You'll learn how to make money consistently and build wealth for the future.

Learn more about getting guidance and support on your journey to success.

FORMULA FOR

SUCCESS

What You'll Learn

- How To Find The Best Deals Without The Competition

- Marketing For Motivated Sellers On Demand

- Proven Negotiation Strategies & Techniques

- Expert Deal Analysis & Due Diligence

- Building A Cash Buyers List

- Navigating Contracts & Forms

- Building A Team & Scaling

- Virtual Assistant Recruiting Process

Why Our Students Join Our Program

The #1 Reasons Why Students Join

Do you value Freedom?

Create a business that runs itself

Work from anywhere in the world from your laptop

Make enough money to buy back your time

Work in a business that you love!

Network with successful real estate investors from around the country

Level up your status as the go-to person for real estate investing

Do you value knowledge & education?

Learn the exact process to launch and grow a successful real estate business

Get the expert secrets that top investors in the country are using

Connect with like minded individuals who are playing the game at all levels

Join the new rich and create your life by design

Are you a systems and process oriented individual?

Follow a step by step blueprint to grow your real estate investing business

strategies to flip houses virtually from anywhere in the world

Get access to our SOP's to build a proven real estate investing system

Unlock our 'AI' Follow up process

Is Legacy and Giving important to you?

Make an impact doing something that you love

Help others discover their freedom and escape the 9-5

Become a powerful force for good in the real estate investing space

Pass the torch to your family and friends

Build a business that create legacy income

We Help You Get Started

Simple Step by Step Process

Step By Step Process:

Start by learning about the real estate market, local laws, regulations, study our online courses, and learn from industry experts

Set Clear Goals:

Determine your financial goals and the strategies that you want to implement in your wholesaling business. Decide on the target market and the number of deals you aim to close within your first 90 days

Build a Powerful Network:

Network with other real estate investors, realtors, and professionals in the industry. Our investing network helps you establish connections with other investors and entrepreneurs

Find Motivated Sellers:

Implement marketing strategies to find motivated sellers, such as digital marketing, sms, direct mail campaigns, AI Lead generation, and bandit signs.

Analyze Deals:

Analyze potential properties to determine their potential for profit. Focus on finding properties with significant equity or in distressed situations where you can negotiate favorable prices

Negotiate Contracts:

Once you find a motivated seller, negotiate a purchase contract with favorable terms, including an adequate inspection period and an assignable clause

Find Cash Buyers:

Build a list of cash buyers, including other investors and rehabbers, who are interested in purchasing wholesale properties. Network and market to expand your buyer pool

Build Your Team & Scale:

After you master the fundamentals, we show you how to vertically integrate your business by hiring the right talent and scaling your business to the next level..

WHAT PEOPLE ARE SAYING

Jason Hutchenson

'Within the first month of being in the program, I closed our my biggest deal to date! $130,000 profit on a Single Family portfolio in Fort Lauderdale. This real estate investing system is the real deal!"

MelQuan Depugh

" Ben has helped me scale my business to the next level by showing me how to put systems in to my business. This has helped me close more deals every single month and given me a proven model to scale.

Graham Solomon

" This is the best investing season that I have ever seen. This learning community has shown me how to simplify my business and focus on closing bigger deals. "

James Prophet

" I was shocked! I contracted my first property and sent it over to the team. They had a full price offer within 24 hours. 15 days later I had my first real estate check in my hand. Ben and his team make the real estate investing process easy to understand. "

Aubrey Wise

" Best decision that I made was take the leap into real estate. Ben's system helped me close my first deal. If you are on the fence about getting started, just do it! You will never look back."

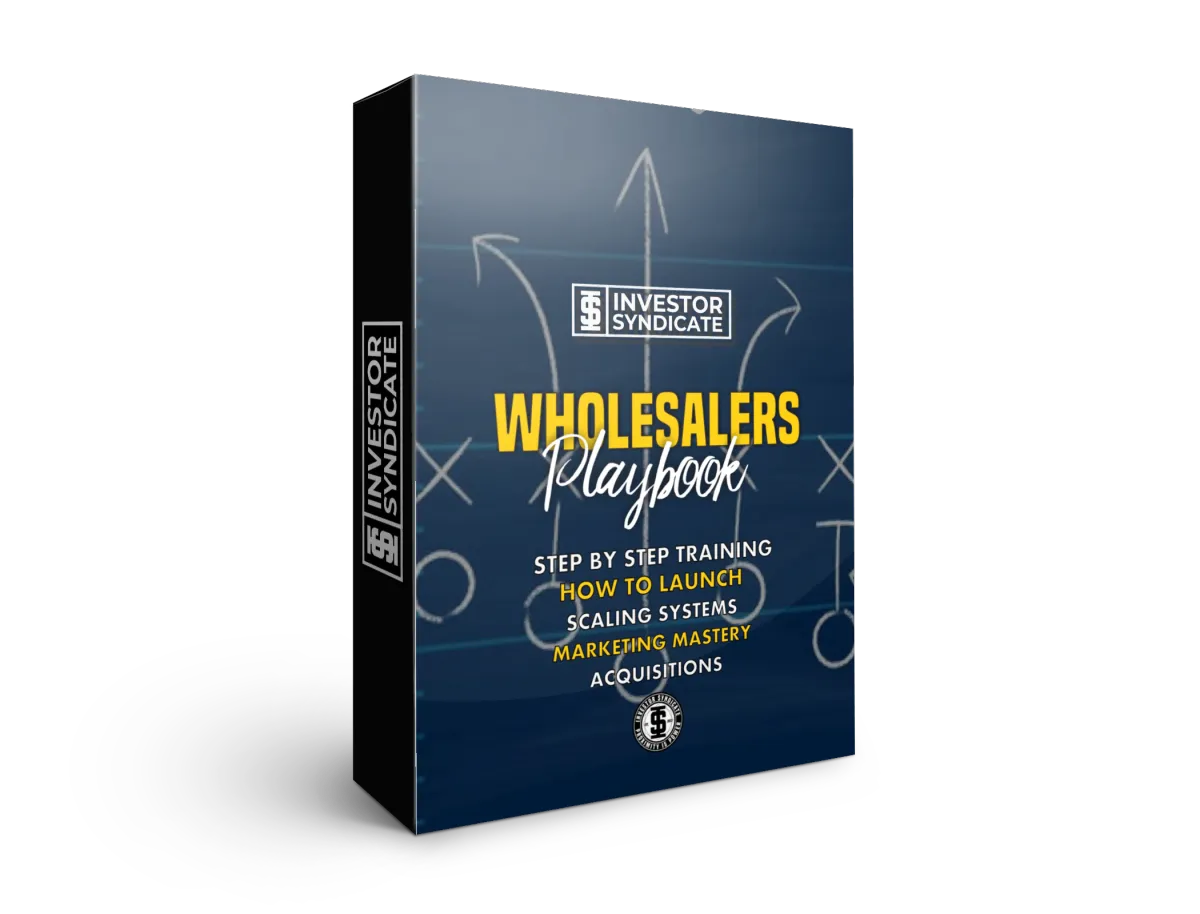

TOOLS & TRAINING RESOURCES

Investor Syndicate

Quick Start Trainings

Take control of your financial future with step by step training

Download Wholesalers Playbook

Training Vault

INNER CIRCLE COMMUNITY